PREPARING FOR CALIFORNIA’S CLIMATE ACCOUNTABILITY PACKAGE

What stands out about these new laws is their broad scope. The state of California is not just focusing on companies headquartered within its borders but is extending its reach to any company that conducts business in the state. This approach significantly widens the net of accountability, meaning that many companies will come under these new regulations.

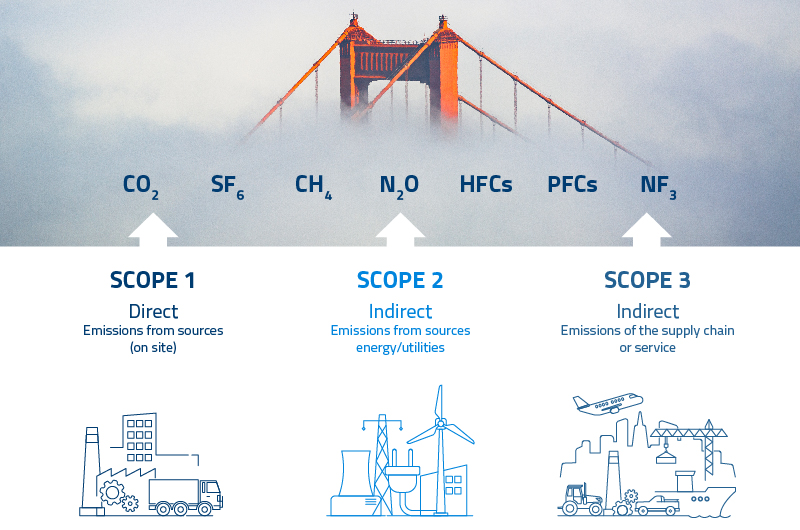

Companies must initiate an action plan for GHG disclosure sooner rather than later. The action plan must include supply chain traceability strategies, along with the data collection, analysis and reporting systems to support them.

Are you looking to start your regulatory compliance journey for the CCDAA, CRFRA or other looming ESG legislation? Optchain’s Carbon Tracking solution is the ideal tool to help in your compliance journey.