HOW TO GET STARTED WITH A TRACK & TRACE SOLUTION FOR REGULATORY COMPLIANCE

Governments are extending excise tax collection programs beyond traditional luxury goods in order to finance post-pandemic economic recovery and healthcare programs. Traditionally, physical tax stamps have been used, yet the industry is now looking towards a more innovative solution that tackles additional issues such as counterfeit and fraud. Track and trace systems and digital tax stamps have come in to help meet these challenges, as well as solve emerging issues such as implementing stamps on high-speed production lines, reducing stamp costs, and reinforcing security requirements.

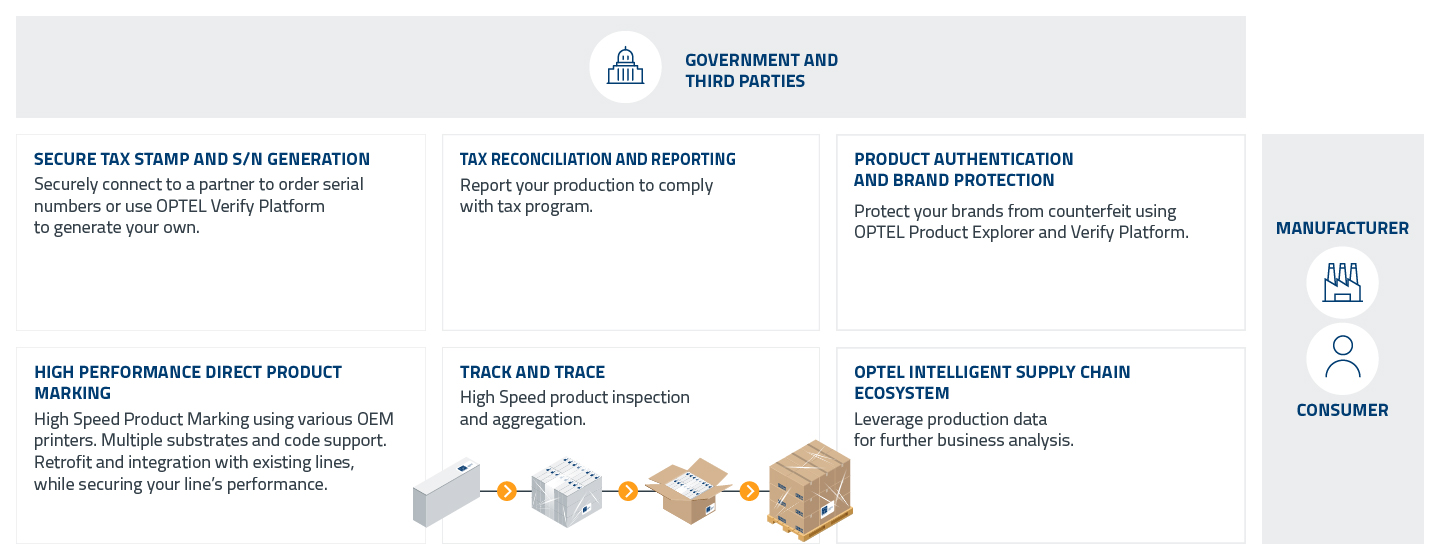

OPTEL offers a scalable and modular Tax Management Solution that uniquely marks, inspects, tracks, traces and validates your products throughout your supply chain. With our technology, you will not only be able to comply with regulations and mitigate counterfeit, but you will also have access to valuable data that enables real-time visibility on your operations and supply chain efficiency. Whether you produce beer, soft drinks, bottled water, or any other excise product, get compliant with tax collection programs with OPTEL, a leading provider of vision systems, track-and-trace technology, and Intelligent Supply Chain solutions.